Log in

yourKONECRANES.COM

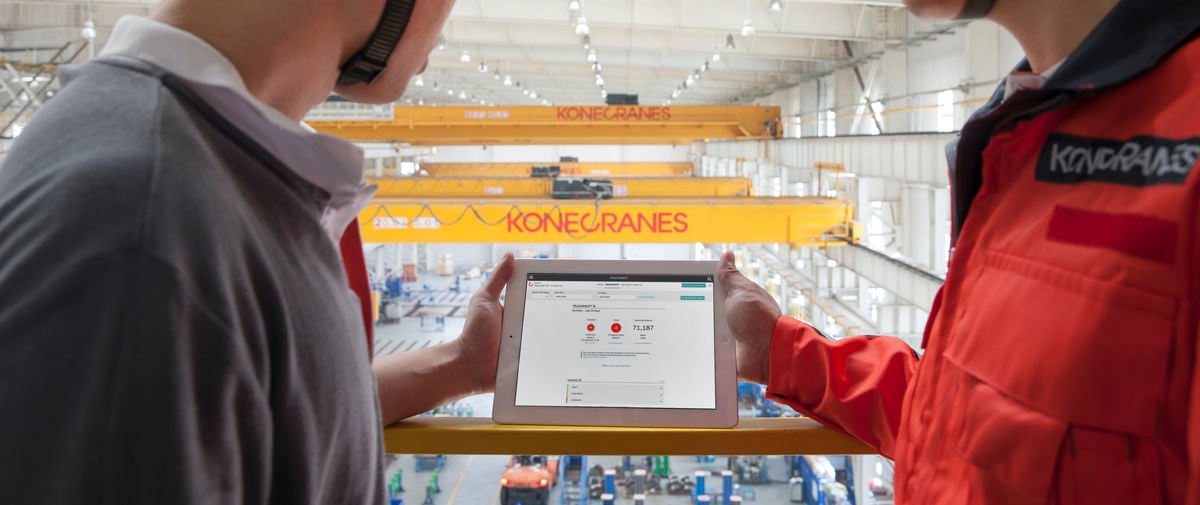

Access your crane usage data, maintenance data and asset details on yourKONECRANES.com. Our cloud-based customer portal gives you a transparent view of service events and activities over any selected time period.

Log in

Konecranes STORE

Konecranes STORE is your online source for spare parts, manuals, accessories and select pre-configured lifting equipment.

Log in

Konecranes ZONE

A personalized experience to discover what Konecranes has to offer. You can even design your own terminal concepts and products and when you are ready to talk, Konecranes experts are at your service.

Optimized for container handling industry, MHC and LT products